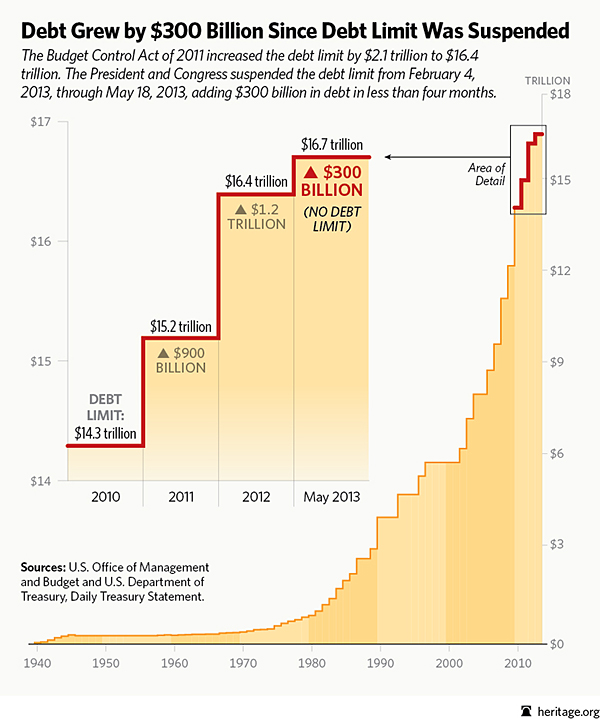

There are so many ways this White House and Congress filled with Democrats are profligates. For one thing, they are trampling upon the constitutional rights of the American people. For another, they continue to spend as if there is such a thing as public money. Rather than curb federal spending, Congress has chosen to once again raise the debt ceiling by another $300 billion, thus increasing the deficit to an ungodly sum of approximately $16.7 trillion when all is said any done. Listen to what the Romina Boccia of The Foundry says about this:

Washington Hits the $16.7 Trillion Debt Ceiling with $300 Billion in New Debt

On May 19, the United States hit its debt ceiling after adding $300 billion in more debt since lawmakers suspended the ceiling in February.But the cash won’t run dry until at least Labor Day, according to Treasury Secretary Jack Lew, whose department can employ a variety of cash management tools to continue spending beyond the official debt deadline.Congress last hit the debt ceiling in January. The President and Congress then decided to “suspend” the debt limit through May 18. This is the first time that lawmakers adopted a debt ceiling date instead of a dollar amount. The Congressional Budget Office explains:In other words, the President and Congress decided in February that they would continue borrowing through May 18, with the new debt limit becoming the then-current limit of $16.394 trillion plus whatever was added on since then. Washington racked up $300 billion in more debt in less than four months, making the current limit $16.7 trillion.This is the pattern of recurrent budget negotiation crises:

- Spend;

- Spend some more;

- Run up against the debt ceiling;

- Resort to “extraordinary measures” to ward off a possible default for a while; and finally,

- Settle for inadequate measures that fail to curb soaring debt in the future.

We’ve entered stage 4, and hitting the debt ceiling should prod lawmakers to accelerate discussions over substantial spending reductions to improve the U.S. fiscal outlook. Despite lower deficits in the short term, the U.S. budget trajectory continues on a fiscal collision course as spending on Social Security, Medicare, Medicaid, and Obamacare is a ticking debt bomb. Stage 5 needs to become: Adopt substantial bipartisan policy reforms that significantly slow spending and put the budget on a path to balance in 10 years or less.As the failed super committee negotiations (which resulted in the all-around-hated sequestration) demonstrated, lawmakers need to put in law real policy changes to the entitlement programs, and not push off tough decisions to a new committee that’s doomed to fail from the get-go. The threat of sequestration was not enough to gather lawmakers around bipartisan reforms. The savings and much more are necessary, though.It’s overdue that lawmakers do their jobs and agree on a budget that focuses spending on federal priorities. The budget should fully fund national defense. It should reduce waste and duplication and eliminate inappropriate spending by privatizing functions better left to the private sector, leaving areas best managed on a more local level to states and localities. And it should make important changes to the entitlement programs so that they become more affordable and benefits are helping those with the greatest needs.Our nation is on a dangerous fiscal course, and the debt ceiling is lawmakers’ opportunity to grab the oars and steer us out of the coming debt storm.

***

This all makes me wonder what ever happened to the president's plan to cut federal spending as part of his 2014 budget? Originally, Obama's budget called for $1.2 trillion in spending cuts in 2014, but with "only" $1.1 trillion in new taxes, but that brings me to the part where there will inevitably be another fiscal cliff or debt ceiling crisis. There is an old saying when one talks about leopards: they cannot change their spots:

The President's Budget for Fiscal Year 2014

So, the president calls for an increase in minimum wage up to $9 per hour. Unfortunately, rather than creating jobs, this will destroy them. Chris Edwards of the Cato Institute reports what labor economist Mark Wilson says about the incoming law:The President’s Fiscal Year 2014 Budget demonstrates that we can make critical investments to strengthen the middle class, create jobs, and grow the economy while continuing to cut the deficit in a balanced way.The President believes we must invest in the true engine of America’s economic growth – a rising and thriving middle class. He is focused on addressing three fundamental questions: How do we attract more jobs to our shores? How do we equip our people with the skills needed to do the jobs of the 21st Century? How do we make sure hard work leads to a decent living? The Budget presents the President’s plan to address each of these questions.To make America once again a magnet for jobs, the Budget invests in high-tech manufacturing and innovation, clean energy, and infrastructure, while cutting red tape to help businesses grow. To give workers the skills they need to compete in the global economy, it invests in education from pre-school to job training. To ensure hard work is rewarded, it raises the minimum wage to $9 an hour so a hard day’s work pays more.The Budget does all of these things as part of a comprehensive plan that reduces the deficit and puts the Nation on a sound fiscal course. Every new initiative in the plan is fully paid for, so they do not add a single dime to the deficit. The Budget also incorporates the President’s compromise offer to House Speaker Boehner to achieve another $1.8 trillion in deficit reduction in a balanced way. When combined with the deficit reduction already achieved, this will allow us to exceed the goal of $4 trillion in deficit reduction, while growing the economy and strengthening the middle class. By including this compromise proposal in the Budget, the President is demonstrating his willingness to make tough choices and his seriousness about finding common ground to further reduce the deficit (Courtesy of The White House).

"There is no free lunch when the government mandates a minimum wage. If the government requires that certain workers be paid higher wages, then businesses make adjustments to pay for the added costs, such as reducing hiring, cutting employee work hours, reducing benefits, and charging higher prices.

…

The main finding of economic theory and empirical research over the past 70 years is that minimum wage increases tend to reduce employment. The higher the minimum wage relative to competitive-market wage levels, the greater the employment loss that occurs. While minimum wages ostensibly aim to improve the economic well-being of the working poor, the disemployment effects of a minimum wages have been found to fall disproportionately on the least skilled and on the most disadvantaged individuals, including the disabled, youth, lower-skilled workers, immigrants, and ethnic minorities.

…

Nobel laureate economist Milton Friedman observed: ‘The real tragedy of minimum wage laws is that they are supported by well-meaning groups who want to reduce poverty. But the people who are hurt most by higher minimums are the most poverty stricken.’

…

In the American economy, low wages are usually paid to entry-level workers, but those workers usually do not earn these wages for extended periods of time. Indeed, research indicates that nearly two-thirds of minimum wage workers move above that wage within one year.

…

While they are often low-paid, entry-level jobs are vitally important for young and low-skill workers because they allow people to establish a track record, to learn skills, and to advance over time to a better-paying job. Thus, in trying to fix a perceived problem with minimum wage laws, policymakers cause collateral damage by reducing the number of entry-level jobs.

…

As Milton Friedman noted, ‘The minimum wage law is most properly described as a law saying employers must discriminate against people who have low skills.’"

***

It seems to me that the president and his "yes-men" in Congress wish to make the majority of Americans poorer by doing this, which would encourage more collective dependence upon the federal government for assistance, and perhaps lead to more votes in upcoming elections after the Democrats, as they always do, successfully achieve their goal of convincing the American people that their plan is making Americans "less poor" and the Republicans who voted the measure down in Congress are against the working collective. Nice going, Mr. President. Once again, you have succeeded in perpetuating the issue of class-warfare.

"The Minimum Wage Is a Jobs and Freedom Killer

The best way to stimulate the economy is by expanding free markets

May 10, 2013

James A. Dorn is vice president for academic affairs at the Cato Institute.

President Obama's proposal to increase the minimum wage to $9 per hour and index it is misguided. It would reduce job opportunities for low-skilled workers (especially minorities), incentivize employers to switch to labor-saving methods of production, increase unemployment of low-productivity workers in low-income households and do nothing to address the underlying causes of poverty.

The legal minimum wage reduces both economic and individual freedom. It makes it illegal for workers to accept (or to keep) a job paying less than the minimum wage, and it prohibits employers from hiring anyone at less than the legal minimum – even if workers are willing to work.

If the prevailing market wage for low-skilled workers is $7.25 per hour and Congress mandates a minimum of $9 per hour, then workers who produce less than that will not be retained or hired. In the long run, as businesses shift to labor-saving methods of production, more low-skilled jobs will disappear than in the short run.

[Read David Cooper: The Case for Raising the Minimum Wage]

In anticipation of a $9-per-hour minimum wage, small businesses are already making plans to shift to automated equipment, self-service tablets and new software to save on higher-priced low-skilled workers. More jobs will be created for skilled workers but at the expense of destroying jobs for low-skilled workers.

Politicians promise workers $9 per hour, but that promise cannot be kept if employers fire (or don't hire) workers who produce less than $9. Most important, if low-skilled workers lose their jobs or can't find jobs at the legal minimum, their actual earnings will be zero.

Evidence shows that when the real (inflation-adjusted) minimum wage exceeds the prevailing market wage for unskilled workers, there will be fewer jobs and a higher unemployment rate – especially in the longer run. If a person with low productivity is prevented from getting a job by the minimum wage, she may go on welfare. Without a job, she will be handicapped and become dependent on government. Rather than develop good work habits and improve her opportunities to move up the income ladder, she will be at a dead end.

[See a collection of political cartoons on the economy.]

High unemployment rates for teenage workers, especially blacks, are a direct consequence of the legally mandated minimum wage. The minimum wage also leads to lower participation rates for low-skilled workers as they become discouraged and drop out of the workforce.

Proponents of the minimum wage focus on workers who retain their jobs but ignore those who lose their jobs or can't find jobs. They also assume that employers can cover the higher minimum by raising prices or paying out of “excess profits.” But most small businesses cannot increase prices and are making only a normal return on their invested capital. Large franchise restaurants, retailers and manufacturers have more leeway. Most are already paying more than the minimum wage. They may favor an increase in the minimum wage in order to reduce competition from small businesses, just as unions favor a higher minimum wage to protect their jobs.

If employers do raise prices, consumers will have less money to spend on other goods and services, so there will be fewer jobs elsewhere. Likewise, if the minimum wage cuts into profits, there will be less investment, and job growth will slow. The best way to stimulate the economy and create jobs is to increase economic growth by expanding free markets, not by increasing government power through a higher minimum wage. (Courtesy of USNews)"The president and congressional Democrats want to make the average American poorer. It has always been a fascination and desire of every Democratic politician to govern in an economic situation whereby there is massive unemployment and more Americans depend upon the federal government for their next ration... in this case, either in the form of an unemployment check or welfare. This is the welfare state Franklin Roosevelt created in 1933, and it is the same one today's Democrats, the most liberal Washington has seen since the days of Lyndon Johnson's "Great Society," have successfully perpetuated.

Furthermore, because the Democrats have spent the federal government into such a massive debt and because the United States serves as the world's creditor nation, John Detrixhe of Bloomberg.com describes the consequences should the government somehow choose to default on the debt this time:

***

U.S. Faces Downgrade in 2013 Without Budget Deal, Moody’s Warns

By John Detrixhe - May 20, 2013 12:00 PM ET

"U.S. policy makers must address debt loads projected to rise later this decade to avoid a 2013 downgrade, even as the latest budget projections are 'credit positive,' according to Moody’s Investors Service.

The U.S. budget deficit will drop to $378 billion in 2015 from a record $1.4 trillion in 2009, according Congressional Budget Office data. The federal government will post an $642 billion deficit this year, the first time in five years that the shortfall has been less than $1 trillion. Moody’s said Sept. 11 that the U.S.’s top Aaa rating would likely be cut to Aa1 if an agreement on the debt ratio isn’t reached.

'The fact that it showed much lower debt levels going forward, we view as a positive development,' Steven Hess, senior vice-president at Moody’s and based in New York, said today in a telephone interview of the CBO forecast. 'More needs to be done on the policy front to address this rising debt ratio.'

While projections from the non-partisan budget office forecast the ratio of U.S. debt to gross-domestic-product declining to less than 71 percent by fiscal year 2018, the CBO forecasts the measure will increase 'thereafter, pointing to the uncertain long-term outlook if reform of entitlement programs does not take place at some point,' Moody’s said today in a report.

Budget Proposals

President Barack Obama sent a $3.8 trillion budget to Congress in April calling for more tax revenue and slower growth for Social Security benefits. The House passed a plan that balances the U.S. budget by fiscal 2023 without raising taxes.

'All of the proposals that are out there, including the budget by the Republicans in the House, and also the administration’s Obama budget that was proposed, all of those show a lower debt ratio in the second half of the decade,' Hess said. “We will wait and see the outcome of all of those negotiations.”

Downgrades don’t necessarily correspond to higher borrowing costs.

Yields on sovereign securities moved in the opposite direction from what ratings suggested in 53 percent of 32 upgrades, downgrades and changes in credit outlook last year, according to data compiled by Bloomberg published in December on Moody’s and Standard & Poor’s grades.

Debt Ceiling

S&P, the world’s largest credit rater, cut the U.S. ranking to AA+ from AAA in August 2011, contributing to a global stock-market rout and sending yields (USGG10YR) on Treasury bonds to record lows rather than driving up rates. Yields on 10-year Treasuries dropped 0.74 percentage point in the seven weeks following the downgrade to a then-record 1.67 percent. The yield stood at 1.97 percent today. Moody’s is the second-biggest credit rater.

Political wrangling over raising the U.S. debt limit was among the reasons S&P downgraded the U.S. in 2011. Hess said the debt ceiling will likely be raised to avoid a default.

'It always has been, and we think always will be' increased and default avoided, he said.

The date the nation hits the ceiling on borrowing could be pushed back as far as mid-September to Sept. 30 from a previous estimate of late August to mid-September, Steve Bell, senior director of economic policy at the Bipartisan Policy Center in Washington, said in an interview. The date has moved as changes in tax policy and an economic rebound boost federal revenue.

There are 'big differences between the parties still,' Hess said. 'On the positive side, the economy is doing a bit better than one might have expected.'

To contact the reporter on this story: John Detrixhe in New York at jdetrixhe1@bloomberg.net

To contact the editor responsible for this story: Dave Liedtka at dliedtka@bloomberg.net."

***

Spending profligacy has ruined this nation financially just as it has in Europe. Because the Democrats have socialized this nation into a culture of dependency, the majority of Americans continue to vote them into public office. The Democratic party chooses not to educate the American people on the dangers of excessive public expenditures, nor does it give hints at what liberties such entitlement programs cost the people. These public works cost money, and let us not kid ourselves when I assert that there is no source of public money other than the taxes coming out of people's pockets. The more we tax the population, the less the economy can thrive. The less the economy thrives, dependency rises. It is a vicious cycle, but it is one perpetuated by the Democrats' more-often-than-not correct gamble that the majority of the American people are, indeed, not educated in the ways of how the federal budget works, nor do they care about anything other than getting "free stuff" from the government when in reality, all they are getting are stuff they paid for in which the money that the government used could have been used to improve that person's life from within the private sector.

The Obama budget is intended to be a tour de force in what is known as economic austerity. By this, the president has presented the American people with a budget that cuts their entitlement programs down such as Social Security and Medicare while increasing taxes across the board on all fronts, including the poor and middle-classes. This is going to wind up becoming political suicide for the Democratic party in the future, for while the deficit is scheduled to be paid off within 10 years, I question the ability of the federal government in this endeavor. For starters, economic austerity has been tried in Europe over the past few years and has been looked upon unfavorably. Look at the following graph showing the rates of unemployment across the Eurozone from April 2, 2012 in The Atlantic by Matthew O'Brien:

However, I choose to play the part of the Devil's Advocate. According to Thomas R. Eddlam of Prison Planet, the real revelations of the Obama budget plan which is supposed to cut the deficit are actually quite different:

"President Obama’s recently released fiscal 2014 budget proposal would continue near-record level deficits despite tax hikes, largely because it would increase spending by more than 20 percent over the next five years. The deficits would continue despite an increase in tax collection by 46 percent over the same period under Obama’s plan.The budget proposal submitted to Congress (two months later than required by law) calls for a $744.2-billion deficitin fiscal 2014, the first under a trillion dollars since Obama took office. The president is able to claim to bring deficits down to the $500 billion per year deficit level after 2014 only because he assumes outlandishly high economic growth rates: about 3.5 percent real GDP growth average for the next four years, along with low 2.2-percent price inflation.Obama’s expectation of 2.6-percent growth in fiscal 2013 is already behind schedule, as the first quarter of the fiscal year (September-December 2012) saw an anemic 0.4-percent annual growth rate. And while the U.S. economy has traditionally rebounded from a recession with four-percent growth for several years, nations with high national debt and a low national savings rates — which the U.S. economy has — historically grow at a much slower rate. The U.S. government currently carries double the proportionate debt load it had during the 1980s, and the economy maintains only two-thirds the national savings rate compared to the same time period. The United States should instead expect a recovery-era growth rate similar to that being experienced by the United Kingdom, Germany, and Japan, which also have high national debt levels (though a higher savings rate than the United States).Only by projecting unreasonably high economic growth does Obama make projected additions to the national debt more modest than his first four years as president. Yet even assuming his growth figures, the president seeks to add an additional $4 trillion to the national debt over the next five years. The proportion of debt compared to the size of the U.S. economy would remain in the 100-110 percent of GDP range, he predicts, because the economy would grow with the debt level. Without that vigorous growth, the debt level would rise significantly. And with a new recession, such as the United Kingdom appears to be entering, the national debt would skyrocket toward Japanese levels of debt.Even Obama’s inflation figure seems unreasonable, and will certainly become so if the economy picks up. The Federal Reserve Bank has been pumping an extra $45 billion per month into the economy under its 'quantitative easing' program. This drastic increase in the money supply (with the same amount of goods in the market) is bound to raise prices eventually.The budget proposal document claims that President Obama 'believes we must invest in the true engine of America’s economic growth” and that this true engine of economic growth is more government spending. More government spending didn’t start true economic growth during either the Bush administration or Obama’s first term, but that hasn’t stopped Obama from trying to do more of the same thing and expecting a different result. More government spending would 'make America once again a magnet for jobs,' his budget document claims. In order to do this, his budget would spend more on a laundry list of pricey items, including “high-tech manufacturing and innovation, clean energy, and infrastructure, … it invests in education from pre-school to job training.'The highlight of the president’s budget proposal is a program which he describes in his letter to Congress this way:My Budget includes $50 billion for up-front infrastructure investments, including a “Fix-it-First” program that makes an immediate investment to put people to work as soon as possible on our most urgent repairs, like the nearly 70,000 structurally-deficient bridges across the country.The budget proposal is loaded with Washington-speak, which is another word for half-truths. Obama claims: 'The Budget does all of these things as part of a comprehensive plan that reduces the deficit and puts the Nation on a sound fiscal course. Every new initiative in the plan is fully paid for, so they do not add a single dime to the deficit.' The above statement is true only in a very narrow and misleading sense. The deficit — the annual increase in the national debt — is smaller than previous Obama years; however, it is larger than during any non-Obama year in U.S. history — i.e., any year of any previous president. And the increased spending is paid for only if one counts more borrowing on the credit of the taxpayers as 'paid for.' The U.S. government would continue to borrow at unprecedented levels into the medium-term future under Obama’s fiscal 2014 budget proposal.Obama reiterates the slogan in his budget letter that 'we cannot just cut our way to prosperity.' Not surprisingly, he proposes no substantial spending cuts in the budget, and admits that his proposal would never balance the federal budget, even as it engages in typical Washington-speak: 'In total, the Budget will cut the deficit by another $1.8 trillion over the next 10 years, bringing the deficit below 2 percent of GDP by 2023 and putting our debt on a declining path.'In essence, if Obama’s budget proposal were a family budgeting document, he would be patting himself on the back with words something like this:Up until this year, I had planned to spend $50,000 more per year than I make in salary at my job. And I had planned to add that extra $50,000 every year onto my credit card. But this year, I’m being financially responsible and reducing the deficit by $180,000 because I plan to spend only $32,000 more than I make, every year, for at least the next 10 years. And even though I will continue to add to my debts, I hope to get a really big promotion at work that will make a lot more money. So I expect that as my debts increase, it will remain proportionate with my income.Harry Hopkins, former advisor to President Franklin Delano Roosevelt, was once reputed to have summarized to Republican fundraisers FDR’s political strategy as “tax and tax, spend and spend, elect and elect.” Though the quote was not an accurate reflection of Hopkins’ words, the mis-attributed words were an able summary of the Roosevelt political strategy.The Obama administration has added 'borrow and borrow' to Roosevelt’s political strategy.This article was posted: Friday, April 12, 2013 at 11:26 am"

This article, in summation, proves what I have thought all along. The president's budget takes into account too many things based on assumptions. He assumes that the economy is going to grow at a relatively high and steady rate. The problem is that during the first quarter of this year, grow was stagnant, at a meager 0.4% during the first quarter of this fiscal year, so it is off to a slow start. Also, if people are supposed to be able to pay higher amounts in taxes based on growth in income, the president should think about his economic policy -- In the U.S., jobs paying between $14 and $21 per hour made up about 60% those lost during the recession, but such mid-wage jobs have comprised only about 27% of jobs gained during the recovery through mid-2012. In contrast, lower-paying jobs constituted about 58% of the jobs regained as of August 2012. (Courtesy of The Washington Post) The "hamburger jobs" many on the Left accused President Reagan of creating in his "economic miracle" of the 1980's are really more accurately applied to "Obamanomics."

So, if the American people who go back to work are making less money, there is still a steady rate of inflation, albeit not to the level America experienced during the stagflation from 1969-1982, and the economy is not growing as quickly as the president assumes it will, what does this mean? It is simple: the deficit will actually be greater because there will be less in tax revenue to pay for the social programs he has in place.

The Myth of Austerity

Mises Daily: Friday, November 30, 2012 by Philipp Bagus

Many politicians and commentators such as Paul Krugman claim that Europe's problem is austerity, i.e., there is insufficient government spending. The common argument goes like this: Due to a reduction of government spending, there is insufficient demand in the economy leading to unemployment. The unemployment makes things even worse as aggregate demand falls even more, causing a fall in government revenues and an increase in government deficits. European governments pressured by Germany (which did not learn from the supposedly fateful policies of Chancellor Heinrich Brüning) then reduce government spending even further, lowering demand by laying off public employees and cutting back on government transfers. This reduces demand even more in a never ending downward spiral of misery. What can be done to break out of the spiral? The answer given by commentators is simply to end austerity, boost government spending and aggregate demand. Paul Krugman even argues in favor for a preparation against an alien invasion, which would induce government to spend more. So the story goes. But is it true?

First of all, is there really austerity in the eurozone? One would think that a person is austere when she saves, i.e., if she spends less than she earns. Well, there exists not one country in the eurozone that is austere. They all spend more than they receive in revenues.

In fact, government deficits are extremely high, at unsustainable levels, as can been seen in the following chart that portrays government deficits in percentage of GDP. Note that the figures for 2012 are what governments wish for.

The absolute figures of government deficits in billion euros are even more impressive.

A good picture of "austerity" is also to compare government expenditures and revenues (relation of public expenditures and revenues in percentage).

Imagine that a person you know spends 12 percent more in 2008 than her income, spends 31 percent more than her income the next year, spends 25 percent more than her income in 2010, and 26 percent more than her income in 2011. Would you regard this person as austere? And would you regard this behavior as sustainable? This is what the Spanish government has done. It shows itself incapable of changing this course. Perversely, this "austerity" is then made responsible for a shrinking Spanish economy and high unemployment.

Unfortunately, austerity is the necessary condition for recovery in Spain, the eurozone, and elsewhere. The reduction of government spending makes real resources available for the private sector that formerly had been absorbed by the state. Reducing government spending makes profitable new private investment projects and saves old ones from bankruptcy.

Take the following example. Tom wants to open a restaurant. He makes the following calculations. He estimates the restaurant's revenues at $10,000 per month. The expected costs are the following: $4,000 for rent; $1,000 for utilities; $2,000 for food; and $4,000 for wages. With expected revenues of $10,000 and costs of $11,000 Tom will not start his business.

Let's now assume that the government is more austere, i.e., it reduces government spending. Let's assume that the government closes a consumer-protection agency and sells the agency's building on the market. As a consequence, there is a tendency for housing prices and rents to fall. The same is true for wages. The laid-off bureaucrats search for new jobs, exerting downward pressure on wage rates. Further, the agency does not consume utilities anymore, leading toward a tendency of cheaper utilities. Tom may now rent space for his restaurant in the former agency for $3,000 as rents are coming down. His expected utility bill falls to $500, and hiring some of the former bureaucrats as dishwashers and waiters reduces his wage expenditures to $3,000. Now with expected revenue at $10,000 and costs at $8,500 the expected profits amounts to $1,500 and Tom can start his business.

As the government has reduced spending it can even reduce tax rates, which may increase Tom's after-tax profits. Thanks to austerity the government could also reduce its deficit. The money formerly used to finance the government deficit can now be lent to Tom for an initial investment to make the former agency's rooms suitable for a restaurant. Indeed, one of the main problems in countries such as Spain these days is that the real savings of the people are soaked up and channeled to the government via the banking system. Loans are practically unavailable for private companies, because banks use their funds to buy government bonds in order to finance the public deficit.

In the end, the question amounts to the following: Who shall determine what is produced and how? The government that uses resources for its own purposes (such as a "consumer-protection" agency, welfare programs, or wars), or entrepreneurs in a competitive process and as agents of consumers, trying to satisfy consumer wants with ever better and cheaper products (like Tom, who uses part of the resources formerly used in the government agency for his restaurant).

If you think the second option is better, austerity is the way to go. More austerity and less government spending mean fewer resources for the public sector (fewer "agencies") and more resources for the private sector, which uses them to satisfy consumer wants (more restaurants). Austerity is the solution to the problems in Europe and in the United States, as it fosters sustainable growth and reduces government deficits.

Lower GDP?

But does austerity not at least temporarily reduce GDP and lead to a downward spiral of economic activity?

Unfortunately, GDP is a quite misleading figure. GDP is defined as the market value of all final goods and services produced in a country in a given period.

There are two minor reasons why a lower GDP may not always be a bad sign.

The first reason relates to the treatment of government expenditures. Let us imagine a government bureaucrat who licenses businesses. When he denies a license for an investment project that never comes into being, how much wealth is destroyed? Is it the expected revenues of the project or its expected profits? What if the bureaucrat has unknowingly prevented an innovation that could save the economy billions of dollars per year? It is hard to say how much wealth destruction is caused by the bureaucrat. We could just arbitrarily take his salary of $50,000 per year and subtract it from private production. GDP would be lower.

Now hold your breath. In practice, the opposite is done. Government expenditures count positively in GDP. The wealth destroying activity of the bureaucrat raises GDP by $50,000. This implies that if the government licensing agency is closed and the bureaucrat is laid off, then the immediate effect of this austerity is a fall in GDP by $50,000. Yet, this fall in GDP is a good sign for private production and the satisfaction of consumer wants.

Second, if the structure of production is distorted after an artificial boom, the restructuring also entails a temporary fall in GDP. Indeed, one could only maintain GDP if production remained unchanged. If Spain or the United States had continued to use their boom structure of production, they would have continued to build the amount of housing they did in 2007. The restructuring requires a shrinking of the housing sector, i.e., a reduced use of factors of production in this sector. Factors of production must be transferred to those sectors where they are most urgently demanded by consumers. The restructuring is not instantaneous but organized by entrepreneurs in a competitive process that is burdensome and takes time. In this transition period, when jobs are destroyed in the overblown sectors, GDP tends to fall. This fall in GDP is just a sign that the necessary restructuring is underway. The alternative would be to produce the amount of housing of 2007. If GDP did not fall sharply, it would mean that the wealth-destroying boom was continuing as it did in the years 2005–2007.

Conclusion

Public austerity is a necessary condition for private flourishing and a rapid recovery. The problem of Europe (and the United States) is not too much but too little austerity — or its complete absence. A fall of GDP can be an indicator that the necessary and healthy restructuring of the economy is underway.

***

So, is austerity a good thing? According to Dr. Bagus, it is. The federal government will be funding too much in the way of social entitlement programs in order to properly execute this. Then, there is what I suggested: there is no way under the president's faulty assumptions that the economy is going to grow at anywhere near rate of his optimistic estimations, and therefore, all of those $1.1 trillion in tax revenue, which with an economy churning out said-revenue at lower-than-expected amounts, will not be enough to cover everything in his budget, thereby creating debt. Therefore, Dr. Bagus has to be right because there the proper execution of austerity will not have taken place in accordance to the conditions that must be met.

Still, though, the president is living a pipe dream as he thinks he can pay off the federal deficit in 10 years. The Congressional Budget Office (CBO), however, thinks differently (Courtesy of the Congressional Budget Office):

An Analysis of the President’s 2014 Budget

report

May 17, 2013

This report by CBO presents an analysis of the proposals contained in the President’s budget request for fiscal year 2014. The analysis is based on CBO’s economic projections and estimating assumptions and models, rather than the Administration’s, and incorporates estimatesby the staff of the Joint Committee on Taxation (JCT) for the President’s tax proposals.

In conjunction with analyzing the President’s budget, CBO has updated its baseline budget projections, which were previously issued in February 2013. Unlike its estimates of the President’s budget, CBO’s baseline projections largely reflect the assumption that current tax and spending laws will remain unchanged, so as to provide a benchmark against which potential legislation can be measured. Under that assumption, CBO estimates that the deficit would total $642 billion in 2013 and that the cumulative deficit over the 2014–2023 period would amount to $6.3 trillion.

The President’s budget request specifies spending and revenue policies for the 2014–2023 period and includes initiatives that would have budgetary effects in fiscal year 2013 as well. According to CBO’s and JCT’s estimates, enactment of the President’s proposals would, relative to CBO’s baseline, boost deficits between 2013 and 2015 but reduce them by increasing amounts from 2016 through 2023. In particular, the President’s policies would have the following consequences for the budget:

- The deficit in 2013 would equal $669 billion (or 4.2 percent of gross domestic product, GDP), $27 billion more than the amount projected in CBO’s baseline.

- In 2014, the deficit would increase slightly in nominal terms, to $675 billion (or 4.1 percent of GDP). That deficit would be $115 billion more than the shortfall projected for next year in CBO’s baseline. In 2015, the deficit would fall to $437 billion (or 2.5 percent of GDP) but remain $59 billion above the amount projected for that year in CBO’s baseline.

- In subsequent years, the deficit would decline further relative to GDP, reaching 2.2 percent in 2016 and 2.0 percent in 2017 and 2018, but then would increase again, remaining above 2 percent of GDP through 2023. Deficits in the 2016–2023 period would be smaller than the amounts in CBO’s baseline by between 0.1 percent and 1.4 percent of GDP each year (see figure below).

- In all, deficits would total $5.2 trillion between 2014 and 2023 (or 2.4 percent of total GDP projected for that period), $1.1 trillion less than the cumulative deficit in CBO’s baseline.

- Federal debt held by the public would increase from 73 percent of GDP ($11.3 trillion) at the end of 2012 to 77 percent ($12.8 trillion) at the end of 2014. In each subsequent year, debt would decline as a percentage of GDP, reaching about 70 percent ($18.1 trillion) in 2023. In contrast, under the assumptions of CBO’s current-law baseline, debt held by the public would be rising relative to GDP after 2018 and would stand at about 74 percent of GDP ($19.1 trillion) in 2023.

The President’s budget contains a host of proposed changes to spending and revenue policies. By CBO’s estimate, those policy changes would boost revenues by $974 billion and reduce outlays (including interest), on net, by $172 billion, yielding a total of $1.1 trillion in deficit reduction over the 2014–2023 period relative to CBO’s current-law baseline. One major proposal involves the automatic procedures originally specified by the Budget Control Act of 2011 (Public Law 112-25). Those procedures took effect in March 2013 and are scheduled to reduce spending in subsequent years. The President proposes to cancel those scheduled reductions, which would boost outlays relative to the amount in the baseline by nearly $1 trillion over the next 10 years. That proposed change would be more than offset by other proposals that would reduce projected deficits. Among those other proposals, the ones with the largest budgetary impact are these:

- Less funding (relative to the amount in CBO’s baseline) for military operations in Afghanistan and for related activities (also known as overseas contingency operations). As specified in law, the baseline incorporates the assumption that funding for such operations and activities will total the amount provided in 2013—$93 billion (with the effects of sequestration included)—each year through 2023 with increases to keep pace with inflation; the President’s budget, by comparison, includes a request for $92 billion for those operations and activities in 2014 and $37 billion in each year thereafter through 2021. Consequently, projected outlays for overseas contingency operations under the President’s proposal are $601 billion less over the 2014–2023 period than those in CBO’s baseline.

- A cap on the extent to which certain deductions and exclusions can reduce a taxpayer’s income tax liability, limiting the amount to no more than 28 percent of those deductions and exclusions. That change would increase revenues by a total of $493 billion over the next decade, JCT estimates.

- No additional funding designated as an emergency requirement after 2013. By contrast, as specified in law, CBO’s baseline incorporates the assumption that the $39 billion of such funding provided in the current year will continue in each year of the projection period, with adjustments for inflation. As a result, projected outlays from funding designated as an emergency requirement under the President’s proposal are $290 billion less through 2023 than those in CBO’s baseline.

- A proposed change to the way tax provisions and certain major benefit programs are indexed for inflation. That change would reduce deficits by an estimated $233 billion through 2023.

Other proposals in the President’s budget include some initiatives that would widen the deficit and some that would narrow it. Those other proposals would change revenues and noninterest outlays by amounts that sum to a net reduction in deficits of $407 billion over the 2014–2023 period ($382 billion in revenues and $26 billion in outlay reductions).

Because the President’s budget would decrease deficits relative to CBO’s baseline projections over the 10-year period, the amount of interest paid on the government’s debt would decline as well. In total, net interest outlays under the President’s budget would be $92 billion below the amounts projected in CBO’s current-law baseline over the 2014–2023 period.

Overall, CBO’s and the Administration’s deficit estimates under the President’s budget are significantly different for this year but similar for the following 10 years. For 2013, CBO’s estimate of the deficit is roughly $300 billion lower than the Administration’s estimate. Most of that difference stems from higher-than-expected tax payments over the past few weeks and recent announcements from Fannie Mae and Freddie Mac about payments that they expect to make to the Treasury. Between 2014 and 2023, the cumulative deficit, if the President’s proposals were enacted, would total $5.2 trillion, according to CBO’s projections, $76 billion (or 1.4 percent) less than what the Administration estimates. CBO’s and the Administration’s estimates of spending under the President’s budget are nearly identical in total: CBO projects just $3 billion more in outlays than the Administration does. However, CBO’s 10-year projections of revenues under the President’s budget are slightly higher than the Administration’s—by $79 billion (or 0.2 percent).

***

So, as we see, the president's plan of balancing the budget by 2023 is, indeed, a pipe dream. Even the CBO claims that his figures do not add up. Meanwhile, this proposition for economic austerity will not be possible because we will be spending too much money, not paying down the federal deficit, and at the same, we will be raising taxes and cutting federal entitlement programs in relation to their present level of funding.

Susan Davis of USA Today reveals more about the CBO's estimates for the federal deficit for 2013:

"WASHINGTON — A continued decline in the federal budget deficit this year is resulting in a better than expected fiscal forecast for 2013 from the non-partisan Congressional Budget Office.The CBO projects a $642 billion budget deficit for fiscal year 2013, down more than $200 billion from its February estimate and the smallest annual shortfall since 2008. It is the lowest level of deficit spending to date under President Obama, who faced $1 trillion or more in annual deficits during his first term.According to CBO, about half of the increase in revenues over the next two years are from new tax rules, such as higher rates and expiration of certain deductions. Revenueis also up due to "factors related mainly to the strengthening economy" including increases in "some components of taxable income" such as wages and capital gains.The long-term deficit projection is also improved: CBO estimates a 2015 deficit of $378 billion. However, the cumulative effect in the next decade of deficit spending through 2023 is projected to be $6.3 trillion.Deficit spending is also expected to increase again in the coming decade because of aging Baby Boomers and their related health care costs, as well as growing interest payments on the debt.CBO projects that the deadline for congressional approval of an increase in the debt ceiling, the nation's borrowing limit, is "most likely" to come in October or November. At prior rates of deficit spending, the debt limit was expected to be reached this summer.The report was good news for the White House. 'The improvements in this CBO report are yet more evidence that the President's policies are contributing to the most rapid deficit reduction since World War II,' Office of Management and Budget spokesman Steve Posner said.The delay buys the president and congressional leaders more time to maneuver the politics of the debt-ceiling vote.Congressional Republicans continue to seek spending cuts or government changes in equal measure to the amount of the debt-ceiling increase, but they have not outlined any specifics.Leading Republicans, including House Ways and Means Chairman Dave Camp, R-Mich., have said they are open to tying a debt-ceiling increase to an overhaul of the federal tax code.Obama and congressional Democrats want a debt-ceiling increase with no strings attached, citing fears that another battle over the debt ceiling could rattle global markets and threaten another credit downgrade.The new CBO outlook takes the urgency out of the fiscal battles that largely defined the previous Congress, such as government spending and raising taxes.The U.S. Senate is instead focused intensely on an overhaul of the nation's immigration laws, while House Republicans are scheduled to vote this week to fully repeal the president's health care law — a vote they have taken 37 times since the GOP took control of the House in 2010.The lower deficits are also a result of decreased federal spending, which may have the long-term impact of slowing economic growth.Moody's Analytics chief economist Mark Zandi said, 'It's excellent budget news.' Zandi said the shrinking deficit "highlights the upside from the fiscal austerity. The stock market's likely also helping to juice tax revenues." But, he said, 'the much lower deficit for this year represents a gamble with aggressive fiscal austerity. So far, so good, but the script is still being written as tax hikes and spending cuts are still being implemented.'Contributing: Tim MullaneyFollow @DaviSusan on Twitter

***

If deficit spending over the next decade is between $5.2 trillion and $6.3 trillion, how does that translate into the federal government implementing a policy of real economic austerity or paying off the federal deficit? Even in 2015 when the deficit is at its lowest, it is still deficit spending. If the federal government is going to implement economic austerity as party of its budget each and every year until 2013, it must cut federal spending on entitlement programs by more than half at the very least. This is where the Democrats have gotten themselves into a real pickle, the fact they have spent so much over the decades that now that it is time to pay down the deficit, they have to cut funding to their favorite social entitlement programs like Social Security, Medicare, and now Obama Care. While one would think this would mark the end of the Democratic party's stranglehold on American politics, this is not so because as I have seen, the liberal mass media has successfully blitzed the Internet with articles and propaganda that the idea of austerity, which has been controversial in Europe provided one calls what is actually occurring there to be "true austerity," is a Republican economic plan created by Rep. Paul Ryan (R-WI). Interestingly, though, this budget is presented within the Obama budget plan. Furthermore, as was mentioned earlier, how does the president realistically expect to raise the needed amount of tax revenue when it is abundantly clear that the economy is simply not growing at a fast enough rate in order to create enough personal income growth by individual Americans when it has been proven through studies that those who have been able to attain a new job are typically earning less than they did under President George W. Bush?

I guess the Democrats can have their cake and eat it, too. They always do, after all. That is why they are the greatest politicians in the history of the United States, and have been since 1932. Somehow, they will find a way to blame the Republicans for all of their screw ups.