"Public servants say, always with the best of intentions, 'What greater service we could render if only we had a little more money and a little more power.' But the truth is that outside of its legitimate function, government does nothing as well or as economically as the private sector."

- Ronald Reagan, 40th President of the United States (1981-1989)

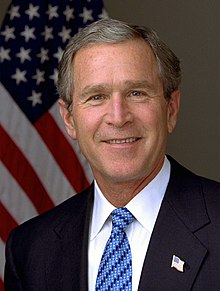

(Above: President Ronald Reagan, who is credited as being the political figure in the United States to usher in modern-day conservative political practices in government.)

Taxation has been a key component in U.S. government ever since the very earliest days of this nation, for it was one of the central themes the British colonists in America opposed -- the concept of taxation without representation in Parliament -- that led to the American Revolution. The history of Western political systems is chalk full of issues with taxation, and there have been many economists who have written books and pamphlets discussing the roll of taxation in government domestic and foreign policies. For the majority of the 20th Century, the United States and Western Europe practiced the macroeconomic concepts espoused by British economist John Maynard Keynes, but later in the century, a paradigm shift led several governments away from this practice and toward the principles most associated with the other major economist from that era, Milton Friedman, when the phenomenon of stagflation took hold during the 1970's. The two economists could not have been more different than night is from day, and it is clear that this difference in principles led to the transformation of the economies of Western governments from socialism that required a buoyant economy to produce tax revenues so that the government could increase taxes on its citizens, to one promoting free trade and less government interference in the ebb and flow of economic progress, including the practice of lowering taxes.

The issue of taxation has become a hot topic yet again today. President Barack Obama pledged in this past campaign to only raise taxes on Americans earning more than $250,000 annually. He lied, including in his 2014 budget plans to raise taxes on all levels of income, including the middle-class and the poor. The President is doing this despite an economy that is on the verge of a double-dip recession due to it actually experiencing a contraction, or decline in growth. Inflation has risen since Obama took office, and in a 2011 article, Canada Free Press said:

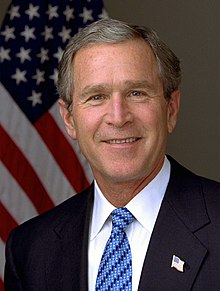

Through my reading of political history in terms of economic policies, I have come to more firmly than ever realize that the soundest economic policies that lead to solid growth are those where taxes are low, not oppressive, as well as a government that does not practice socialism. This practice of low taxation and non-socialism is most characteristic of the conservative establishment in nations around the world, or in the United States, the Republican party. There have only ever been five presidents who practiced sound economic policies over the past 91 years, and four were Republicans: Warren G. Harding, Calvin Coolidge, John F. Kennedy, Ronald Reagan, and George W. Bush. They each cut taxes in order to buoy up sagging economies, and their strategies worked to perfection. The most notable of these presidents is Reagan, who led America's drive toward the "economic miracle" after various estimates concluded that the rising unemployment and inflation that had existed from as early as 1969, after the Johnson administration's tax hike known as the "surcharge" had been in affect for close to a year. Reagan's economic policy, known both as "supply-side economics" or "Reaganomics," restored faith in the American way of life to millions of Americans, resulting in the creation of nearly 20 million new jobs, and a growth in financial prosperity at all income levels. The follow article from Forbes describes the economic strategies of both Reagan and Obama and why "The Gipper's" was far superior:

The issue of taxation has become a hot topic yet again today. President Barack Obama pledged in this past campaign to only raise taxes on Americans earning more than $250,000 annually. He lied, including in his 2014 budget plans to raise taxes on all levels of income, including the middle-class and the poor. The President is doing this despite an economy that is on the verge of a double-dip recession due to it actually experiencing a contraction, or decline in growth. Inflation has risen since Obama took office, and in a 2011 article, Canada Free Press said:

"The Obama administration does not seem concerned with addressing the dire issue of inflation caused by its overspending and out of control money printing."Such economic practices as these will surely result in further unemployment and higher inflation. The implementation of the Affordable Health Care Act (aka. "Obama Care") will cost 800,000 Americans their jobs over a period of a decade due to employers being forced to layoff workers due to not having the financial means to pay for the new health care plan. (Courtesy of cnsnews.com) All-in-all, the practice of Keynesianism in economic policy that proved to be a complete and utter failure at the end of the 1970's has returned under Obama, and with it will result in the ruination of this nation.

Through my reading of political history in terms of economic policies, I have come to more firmly than ever realize that the soundest economic policies that lead to solid growth are those where taxes are low, not oppressive, as well as a government that does not practice socialism. This practice of low taxation and non-socialism is most characteristic of the conservative establishment in nations around the world, or in the United States, the Republican party. There have only ever been five presidents who practiced sound economic policies over the past 91 years, and four were Republicans: Warren G. Harding, Calvin Coolidge, John F. Kennedy, Ronald Reagan, and George W. Bush. They each cut taxes in order to buoy up sagging economies, and their strategies worked to perfection. The most notable of these presidents is Reagan, who led America's drive toward the "economic miracle" after various estimates concluded that the rising unemployment and inflation that had existed from as early as 1969, after the Johnson administration's tax hike known as the "surcharge" had been in affect for close to a year. Reagan's economic policy, known both as "supply-side economics" or "Reaganomics," restored faith in the American way of life to millions of Americans, resulting in the creation of nearly 20 million new jobs, and a growth in financial prosperity at all income levels. The follow article from Forbes describes the economic strategies of both Reagan and Obama and why "The Gipper's" was far superior:

"Reaganomics Vs. Obamanomics: Facts And Figures by Peter Ferrara

"In February 2009 I wrote an article for The Wall Street Journal entitled “Reaganomics v Obamanomics,” which argued that the emerging outlines of President Obama’s economic policies were following in close detail exactly the opposite of President Reagan’s economic policies. As a result, I predicted that Obamanomics would have the opposite results of Reaganomics. That prediction seems to be on track.

When President Reagan entered office in 1981, he faced actually much worse economic problems than President Obama faced in 2009. Three worsening recessions starting in 1969 were about to culminate in the worst of all in 1981-1982, with unemployment soaring into double digits at a peak of 10.8%. At the same time America suffered roaring double-digit inflation, with the CPI registering at 11.3% in 1979 and 13.5% in 1980 (25% in two years). The Washington establishment at the time argued that this inflation was now endemic to the American economy, and could not be stopped, at least not without a calamitous economic collapse.

President Reagan campaigned on an explicitly articulated, four-point economic program to reverse this slow motion collapse of the American economy: All of the above was accompanied by double-digit interest rates, with the prime rate peaking at 21.5% in 1980. The poverty rate started increasing in 1978, eventually climbing by an astounding 33%, from 11.4% to 15.2%. A fall in real median family income that began in 1978 snowballed to a decline of almost 10% by 1982. In addition, from 1968 to 1982, the Dow Jones industrial average lost 70% of its real value, reflecting an overall collapse of stocks.

- 1. Cut tax rates to restore incentives for economic growth, which was implemented first with a reduction in the top income tax rate of 70% down to 50%, and then a 25% across-the-board reduction in income tax rates for everyone. The 1986 tax reform then reduced tax rates further, leaving just two rates, 28% and 15%.

- 2. Spending reductions, including a $31 billion cut in spending in 1981, close to 5% of the federal budget then, or the equivalent of about $175 billion in spending cuts for the year today. In constant dollars, nondefense discretionary spending declined by 14.4% from 1981 to 1982, and by 16.8% from 1981 to 1983. Moreover, in constant dollars, this nondefense discretionary spending never returned to its 1981 level for the rest of Reagan’s two terms! Even with the Reagan defense buildup, which won the Cold War without firing a shot, total federal spending declined from a high of 23.5% of GDP in 1983 to 21.3% in 1988 and 21.2% in 1989. That’s a real reduction in the size of government relative to the economy of 10%.

- 3. Anti-inflation monetary policy restraining money supply growth compared to demand, to maintain a stronger, more stable dollar value.

- 4. Deregulation, which saved consumers an estimated $100 billion per year in lower prices. Reagan’s first executive order, in fact, eliminated price controls on oil and natural gas. Production soared, and aided by a strong dollar the price of oil declined by more than 50%.

These economic policies amounted to the most successful economic experiment in world history. The Reagan recovery started in official records in November 1982, and lasted 92 months without a recession until July 1990, when the tax increases of the 1990 budget deal killed it. This set a new record for the longest peacetime expansion ever, the previous high in peacetime being 58 months.

During this seven-year recovery, the economy grew by almost one-third, the equivalent of adding the entire economy of West Germany, the third-largest in the world at the time, to the U.S. economy. In 1984 alone real economic growth boomed by 6.8%, the highest in 50 years. Nearly 20 million new jobs were created during the recovery, increasing U.S. civilian employment by almost 20%. Unemployment fell to 5.3% by 1989.

The shocking rise in inflation during the Nixon and Carter years was reversed. Astoundingly, inflation from 1980 was reduced by more than half by 1982, to 6.2%. It was cut in half again for 1983, to 3.2%, never to be heard from again until recently. The contractionary, tight-money policies needed to kill this inflation inexorably created the steep recession of 1981 to 1982, which is why Reagan did not suffer politically catastrophic blame for that recession.

Real per-capita disposable income increased by 18% from 1982 to 1989, meaning the American standard of living increased by almost 20% in just seven years. The poverty rate declined every year from 1984 to 1989, dropping by one-sixth from its peak. The stock market more than tripled in value from 1980 to 1990, a larger increase than in any previous decade.

In The End of Prosperity, supply side guru Art Laffer and Wall Street Journal chief financial writer Steve Moore point out that this Reagan recovery grew into a 25-year boom, with just slight interruptions by shallow, short recessions in 1990 and 2001. They wrote:

'We call this period, 1982-2007, the twenty-five year boom–the greatest period of wealth creation in the history of the planet. In 1980, the net worth–assets minus liabilities–of all U.S. households and business … was $25 trillion in today’s dollars. By 2007, … net worth was just shy of $57 trillion. Adjusting for inflation, more wealth was created in America in the twenty-five year boom than in the previous two hundred years.'

The capital gains tax rate will soar by nearly 60%, counting the new Obamacare taxes going into effect that year. The total tax rate on corporate dividends would increase by nearly three times. The Medicare payroll tax would increase by 62% for the nation's job creators and investors. The death tax rate would increase by 55%. In his 2012 budget and his recent national budget speech, President Obama's first act was a nearly $1 trillion stimulus bill. In his first two years in office he has already increased federal spending by 28%, and his 2012 budget proposes to increase federal spending by another 57% by 2021.

His monetary policy is just the opposite as well. Instead of restraining the money supply to match money demand for a stable dollar, slaying an historic inflation, we have QE1 and QE2 and a steadily collapsing dollar, arguably creating a historic reflation.

And instead of deregulation we have across-the-board re-regulation, from health care to finance to energy, and elsewhere. While Reagan used to say that his energy policy was to “unleash the private sector,” Obama’s energy policy can be described as precisely to leash the private sector in service to Obama’s central planning “green energy” dictates.

As a result, while the Reagan recovery averaged 7.1% economic growth over the first seven quarters, the Obama recovery has produced less than half that at 2.8%, with the last quarter at a dismal 1.8%. After seven quarters of the Reagan recovery, unemployment had fallen 3.3 percentage points from its peak to 7.5%, with only 18% unemployed long-term for 27 weeks or more. After seven quarters of the Obama recovery, unemployment has fallen only 1.3 percentage points from its peak, with a postwar record 45% long-term unemployed.

Previously the average recession since World War II lasted 10 months, with the longest at 16 months. Yet today, 40 months after the last recession started, unemployment is still 8.8%, with America suffering the longest period of unemployment that high since the Great Depression. Based on the historic precedents America should be enjoying the second year of a roaring economic recovery by now, especially since, historically, the worse the downturn, the stronger the recovery. Yet while in the Reagan recovery the economy soared past the previous GDP peak after six months, in the Obama recovery that didn’t happen for three years. Last year the Census Bureau reported that the total number of Americans in poverty was the highest in the 51 years that Census has been recording the data.

Moreover, the Reagan recovery was achieved while taming a historic inflation, for a period that continued for more than 25 years. By contrast, the less-than-half-hearted Obama recovery seems to be recreating inflation, with the latest Producer Price Index data showing double-digit inflation again, and the latest CPI growing already half as much.

These are the reasons why economist John Lott has rightly said, “For the last couple of years, President Obama keeps claiming that the recession was the worst economy since the Great Depression. But this is not correct. This is the worst “recovery” since the Great Depression.'

However, the Reagan Recovery took off once the tax rate cuts were fully phased in. Similarly, the full results of Obamanomics won’t be in until his historic, comprehensive tax rate increases of 2013 become effective. While the Reagan Recovery kicked off a historic 25-year economic boom, will the opposite policies of Obamanomics, once fully phased in, kick off 25 years of economic stagnation, unless reversed?

What is so striking about Obamanomics is how it so doggedly pursues the opposite of every on [sic] of these planks of Reaganomics. Instead of reducing tax rates, President Obama is committed to raising the top tax rates of virtually every major federal tax. As already enacted into current law, in 2013 the top two income tax rates will rise by nearly 20%, counting as well Obama's proposed deduction phase-outs.

The purpose behind this blog entry, through nearly a week of study, research, and writing, is to present you the facts about the president's record on the economy using history and data that correlates a presidential administration's tax policy, coupled with the type of economic policy that president implemented (Keynesianism/socialism, monetary/supply-side), in order to determine whether that administration's economy was effective in creating the proper conditions by which the population thrived at a high-standard of living. Through this study, I hope to disprove all of the Left's assertions once and for all that the Obama administration's handling of the economy is flawed in no small part because of his philosophy behind taxation and a porous monetary policy.

The American Attitude Behind Taxation Began with the Revolution

(Above: Pictures of Founding Fathers James Otis and Patrick Henry. Courtesy of Wikipedia.)

America's founding was based in no small part on the issue of taxation. On February 10, 1763, the French and Indian War in North America (in Europe, the Seven Years War) concluded with Great Britain and France signing the Treaty of Paris. For the British, the spoils of war came in the form of the French being obligated to cede all of Canada to them in exchange for Martinique and Guadalupe. Spain, in addition, was given the Louisiana territory in exchange for Florida which was given to the British. Despite the major victory that expanded the land area of her America colonies, Britain faced stressed finances that plunged the nation into debt. In an effort to pay down on this debt, the government began exploring possible solutions.

As the British Parliament assessed possible measures for generating funds, it was decided that new taxes would be levied on the American colonies in order to offset some of the costs of their defense. On April 5, 1764, the Sugar Act was enacted that placed a tax on three pence per gallon on molasses as well as listed specific goods which could be exported to Britain. While this tax was half that of the stipulation behind the 1733 Sugar and Molasses Act, the new Sugar Act called for active enforcement and hit the colonies during an economic downturn. The passage of the Sugar Act led to outcries from colonial leaders, the most famous and vociferously-vocalized being "taxation without representation" since there were no Members of Parliament (MP's) from the American colonies.

The economic situation was further exacerbated a year later when Parliament passed the Currency Act, preventing the colonies from printing paper money. As many American businesses engaged in credit sales with Britain, they were crippled when several financial crises gripped London in the 1760's and 1770's. These issues forced British merchants to call in their debts. Unable to generate any form of liquid currency, American businesses were frequently ruined and the colonial economy damaged. Outraged by these new laws and the new Quartering Act that required colonial citizens to house and feed British troops, the American colonies began to systematically boycott British goods.

On March 22, 1765, Parliament passed the Stamp Act which called for tax stamps to be placed on all paper goods sold in the colonies. This represented the first attempt to levy a direct tax on the colonies and was met with fierce opposition and protests. Let by such vocal orators as James Otis and Patrick Henry, the colonists began a massive boycott of British goods causing colonial imports to fall from £2,250,000 in 1764 to £1,944,000 in 1765. In several colonies, new protest groups called the "Sons of Liberty" formed. The most active town for the "Sons of Liberty" was Boston, where the protest group attacked an admiralty court and looted the home of the chief justice.

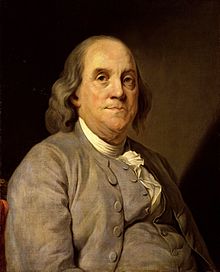

That October, delegates from nine colonies gathered in New York for the Stamp Act Congress. Guided Pennsylvanian John Dickinson, the congress drew up the Declaration of Rights and Grievances, which stated that as the colonies had no representation in Parliament, the tax was unconstitutional and against their rights as Englishmen. In London, colonial representative Benjamin Franklin argued a similar point and warned that continued taxation could lead to rebellion. Relenting, Parliament repealed the tax, but passed the Declaratory Act in March 1766 stating that it retained the power to tax the colonies.

(Above: Picture of Benjamin Franklin. Courtesy of Wikipedia.)

Still seeking a way to generate revenue, Parliament passed the Townshend Acts on June 29, 1767. An indirect tax, the tax placed import duties on commodities such as lead, paper, paint, glass, and tea. In addition, they created three new Admiralty courts in the colonies and reaffirmed the legality of the writs of assistance. Just as with past taxation attempts, the colonies reacted with protests of "taxation without representation." While colonial leaders organized boycotts of the taxed goods, smuggling increased, and efforts commenced to develop domestically-produced alternatives.

Over the next three years, boycotts and protests continued in the colonies. These came to a head on March 5, 1770, when angry colonist began throwing snowballs and rocks at British troops guarding the Customs House in Boston. In the commotion, British troops opened fire on the mob, killing three immediately and later adding two more casualties when those individuals died from their wounds. The soldiers involved were indicted for murder and their trial scheduled for that fall. Defended by John Adams, the accused were acquitted of the charges, though two were convicted of manslaughter. With tensions in the colonies reaching a breaking point, Parliament repealed most of the Townshend Acts April 1770, but left a tax on tea.

On May 10, 1773, Parliament passed the Tea Act with the goals of assisting the ailing East India Company. Prior to the passage of the law, the company had been required to sell its tea through London where it was taxed and duties assessed. Under the new legislation, the company would be able sell tea directly to the colonies without the additional cost. As a result, tea prices in America would be reduced, with only the Townshend Act duty assessed. Aware this was an attempt by Parliament to break the colonial boycott of British goods, groups such as the Sons of Liberty spoke out against the act.

Across the colonies, British tea was boycotted and attempts were made to produce tea locally. In Boston, the situation climaxed in late November 1773, when three ships carrying East India Company tea arrived in the port. Rallying the populace, the Sons of Liberty dressed as Native Americans and boarded the ship on the night of December 16. Carefully avoiding damaging other property, the "raiders" tossed 342 chests of tea into Boston Harbor. A direct affront to British authority, the "Boston Tea Party" forced Parliament to take action against the colonies.

In response to the colonial attack on the tea ships, Parliament passed a series of punitive laws in early 1774 called the Coecive Acts, or better known to colonists as the Intolerable Acts. The first of these, the Boston Port Act, closed Boston to shipping until the East India Company had been repaid for the destroyed tea. This was followed by the Massachusetts Government Act which allowed the Crown to appoint most positions in the Massachusetts colonial government. Along with these new laws, a new Quartering Act was enacted which allowed British troops to use unoccupied buildings as quarters within the colonies.

In Boston, royal authority was asserted with the arrival of Lieutenant General Thomas Gage as the new royal governor on April 2, 1774. Initially well-received as most colonists were excited to see the hated Governor Thomas Hutchinson depart, Gage did not move to quash the Sons of Liberty for fear of escalating the situation.

Using a variety of committees of correspondence, the colonial leaders began planning a congress to discuss the repercussions of the Coercive/Intolerable Acts. Meeting at Carpenters Hall in Philadelphia, representatives from twelve colonies (Georgia did not attend) convened on September 5, 1774. In the discussions that followed, some delegates argued in favor of establishing a new government system, while others lobbied for reconciliation with Britain.

As a result of the Congress, which convened October 26, the colonies agreed to the formation of a new Continental Association. The compact stipulated that the colonies would boycott all British goods starting on December 1, 1774 and would also boycott the West Indies unless the islands agreed to boycott British goods as well. As a result, importation of British goods dropped 97% in 1775. In addition, if the Intolerable Acts were not repealed, the colonies would cease exporting to Britain effective September 10, 1775. Departing Philadelphia, the ensemble decided to meet again in May 1775 for a Second Continental Congress.

In the spring of 1775, Gage began a series of raids with the goal of disarming the colonial militias. On the evening of April 18, Gage ordered some of his troops to march to Concord to seize munitions and gunpowder. The next morning, British troops encountered colonial militia in the village of Lexington. While the forces faced off, a shot rang out. Though the source of the shot is unknown, it began what would be an eight year war. (Details of information courtesy of About.com Military History)

Thereafter, debts incurred from the American Revolution were paid by revenue collected from excise taxes levied by the Congress on such things as sugar, alcohol, tobacco, carriages, auctioned property, and certain legal documents.

Now that there was a new nation and a proper representation of Americans democratically in the form of a republican government, many citizens were still opposed to -- and even resisted -- taxes that they thought were unfair or unacceptable.

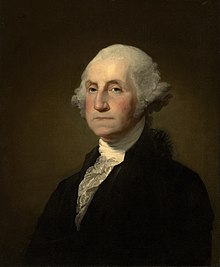

With the Whiskey Rebellion of 1794 taking place over the collection of taxes on whiskey, President George Washington sent in federal troops to crush the rebellion. This action set a significant precedent that the federal government from which the federal government would not waver when it came to creating tax revenue and collecting taxes. The rebellion also established that the struggle against the British over taxation that resulted in the Declaration of Independence (1776) did not go away simply because a new, representative government was formed.

The first direct taxes on landowners and owners of houses, were imposed by the federal government during the conflict with France. Because these taxes were paid directly to the government by taxpayers based on the item value, which was the basis for the tax, they were called direct taxes.

Federal taxes that followed evolved based on the critical role of the issue surrounding direct taxes versus indirect taxes. In 1802, following Thomas Jefferson's election to the presidency, direct taxes were eliminated. Other than excise taxes, there were no other forms of internal revenue. Thus, Jefferson established the concept of a less-intrusive government on the American people following two presidencies that propelled the government's agenda on taxation in the early republic.

To pay for the War of 1812, Congress raised some new customs duties, implemented new excise taxes, and also raised revenues by issuing Treasury Notes. These taxes were repealed in 1817, at the end of the Madison administration. For 44 years, there would be no internal revenue collected by the federal government. Most of the government's revenue would come from public land sales and high customs duties.

At the time of taxes during the Civil War, the Revenue Act of 1861 was passed by Congress that resulted in the previous excise taxes being reinstated and the implementation of the United States' first ever personal income tax, whereby incomes of over $800.00 annually would be taxed at a rate of 3%. As most existing federal taxes had existed in the forms of duties and excises, taxing income took the federal system down a new path. Congress quickly realized there were some issues with the new income tax and thus did not collect them until a year later. With the war clearly dragging on, the federal debt was growing by approximately $2 million per day. By spring of 1862, it was clear the government was going to have to find another source of supplementary revenues.

To deliver these new revenues, Congress passed a whole new set of excise taxes on July 1, 1862 on things like yachts, pool tables, pianos, telegrams, feathers, leather, iron, playing cards, gunpowder, drugs, whiskey, and patent medicines. They also created and collected new license fees for many trades and professions and taxed many legal documents. There were central reforms made in the 1862 law that kind of prognosticated the main themes of many of the taxes in place today.

The concept the of the graduated income tax was initiated at this time. For example, Congress placed a multi-tiered tax rate structure that taxed incomes of $10,000 at 3% -- but made the tax rate 5% for more than $10,000. They enacted a standard deduction of $600 while also allowing numerous deductions for rental housing, repairs, loses, and other taxes paid. Also, to make sure taxes were paid on time, taxes were withheld by employers.

When the Civil War ended in 1865, much of the tax revenue was no longer needed and therefore many taxes were rescinded. By 1868, liquor and tobacco taxes were the federal government's primary sources of revenue. In 1872, they even did away with the personal income tax. For the next 48 years after 1868, the remaining excise taxes accounted for nearly 90% of the federal government's income.

As mention above, in order to help pay for its war effort in the American Civil War, Congress imposed its first personal income tax in 1861.

For the next 15 years (1896-1910), the primary source of revenue was via high tariffs due to the lack of an income tax and because there was such opposition to other forms of direct taxation. In 1899, the Wilson-Gorman Act was passed in order to fund the Spanish-American War. This raised revenues through bond sales, taxes on recreational facilities used by employees, increased tobacco and beer taxes, and also on chewing gum. When the Act expired three years later, federal revenues dropped from 1.7% to 1.3% of domestic GDP.

As the result of the 1895 Court ruling on the income tax, the Wilson-Gorman Act resorted to traditional methods of raising revenues, although there were ongoing, vigorous debates on other methods and possible new ways to raise revenues. According to Easy-Tax Information.com, it became quite clear apparent throughout the country that excise taxes and high tariffs weighed much more heavily on the less prosperous was were thus not economically sensible. Ultimately, the debate over income taxes was between members of Congress in the South and West who represented rural and agricultural areas, and those in the Northeast industrial areas. In time, there was a agreement to enact a tax on business income that the leaders in Washington called an "excise tax."

More importantly, Congress passed a constitutional amendment allowing the government to tax the lawful income of U.S. citizens regardless of state population. This amendment, the 16th Amendment, was ratified by 36 states by 1913, and the Democratic Congress enacted a new federal income tax law in October of that year with rates ranging from 1% all the way to 7% for those Americans earning a salary of more than $500,000. This was signed into law by President Woodrow Wilson, a Democrat who was a leader in the Progressive movement that championed the cause of an income tax. Thus. the Populists and Progressives who infiltrated the federal government during the late 19th and early 20th Centuries got their wish -- the spark that would eventually result in the creation of the welfare state, big government, and the government's constitutional mandate to manipulate the economy through the implementation of taxes. Also, this would mark the beginning toward the concept of class warfare in American society that would become so prevalent, particularly when Franklin Roosevelt took office in 1933.

Wilson, through the passage of the 16th Amendment, created the prototype behind the Democratic big government politics. Some of the ways he expanded the size of government were as follows:

By 1917, the federal budget for that one year was almost the same as all of the budgets for the previous 25 years combined! The war and all of the newly collected tax revenues were the driving factors in the absurdly expanded federal budget! The government had become too big, and too oppressive in the views of most of today's conservatives. It was about this time that income taxes began to get out of control. A s the government wanted even more tax revenues, Congress passed the 1917 War Revenue Act, which increased tax rats even higher, while reducing exemptions at the same time. Before this latest Act, a 15% tax rate only kicked in on incomes over $1.5 million. But now, that income bracket was required to pay 67%, while those earning just $40,000 were slapped with a 16% rate.

Then Congress did it again in 1918 with yet another Act, raising the bottom and top tax rates to 6% and 77% respectively! These back-to-back annual increases brought 1918 tax revenues to $3.6 billion, up from the 1916 revenues of just $761 million. According to Easy-Tax Information.com, that is an increase in federal revenue of 475%. At this point, the tax burden was equal to 25% of GDP and while a full third of the war's cost was being funded by the income tax, still only about 5% paid income taxes at all. And while the economy was thriving due to the wartime economy, nevertheless the institution of class warfare had accelerated.

By violating the spirit for which the American Revolution and the Constitution were fought, Woodrow Wilson said these words regarding his record as president:

In an article on Fee.org, the concept of the income tax according to the article's author Dr. Gene Smiley. professor at Marquette University, was to redistribute wealth and income. However, with the 1920's tax and economic policies, some of those trends were bucked, and the economy prospered

Hoover in late 1930 created The President's Emergency Committee on Employment (PECE), as unemployment reached 11%. PECE tried to mobilize private charity and encouraged states, cities and Congress to increase public works spending as a stimulus. They did so, and soon the states and cities were nearly bankrupt on their own. In August 1931, finally realizing this was not a normal cycle, Hoover replaced PECE with the President's Organization on Unemployment Relief (POUR), headed by Walter S. Gifford, president of American Telephone and Telegraph, the nation's largest private company. POUR expanded, coordinated, and improved local and state relief efforts; but the economy relentlessly went lower.

In early 1931 Hoover signed the Wagner-Graham Stabilization Act, which set up the Federal Stabilization Board to initiate public works such as dams and highways. Public works did increase throughout the decade after 1929, but not enough to cover the downturn in private construction, let alone all the other negative sectors. In 1931 the mood in Congress --equally divided after the GOP lost seats in 1930--remained strongly opposed to federal relief; even the National Council of Social Workers refused to endorse relief as a principle at their convention in May. New urban slums--shantytowns derisively called "Hoovervilles" by the Democrats--were rising in the nation's largest cities.

Hoover had played a major role in creating the long-term (20-year) mortgage in the 1920s. In times of prosperity mortgages accelerated national growth, as houses were built and lived in before people had saved enough to pay cash for one. But in a downturn mortgages debt hurt the economy. people sacrificed current consumption to pay the mortgage so they would not lose the house and all the money they put in it. To pay the mortgage they gave up luxuries (like a telephone or new car), made do with old clothes, canceled vacations. The foreclosure rate pushed up and construction of new houses ceased. It was much like 2008-09. Like President Obama, Hoover moved to resolve the mortgage crisis. He called for the Federal Home Loan Bank Act (passed in July 1932), that created a system of federal home loan banks to discount home mortgages. The Federal Home Loan Banks received $125 million in capital (comparable to $32 billion in 2009) to fund the home mortgages held by financial concerns. Hoover believed that the ability of private lending institutions to secure new sources of capital would encourage them to make more construction loans and revive the industry. But it had little effect. In 1932, Hoover lost in a landslide to Franklin Roosevelt, ushering in the New Deal and a decisive political realignment known as the Fifth Party System.

The Era of Bill Clinton, 1993-2001, and the 1997 Taxpayer Relief Act and the Real Sources Behind the Economic Boom During the 1990's -- and Its Eventual Downfall

The Tax and Economic Record of Barack Obama

Here is what USA Today says about the Obama record on taxation with regard to the Fiscal Cliff Agreement:

A History of Taxation as It Relates to the Economy in America

Colonial America

It was unusual for the single taxpayer to have much contact with the Federal taxing establishment because the majority of the tax revenue resulted from customs duties, tariffs, and excise taxes. These were all indirect forms of taxation. The economy of the colonies was based mostly on the success of agriculture. Even as the economy expanded throughout the 18th Century, it only inched toward industrialization by 1776, when the Declaration of Independence was signed. The economy of the thirteen original colonies was actually relatively stable in stark contrast to the 20th and 21st Centuries. Dynamic economic expansion occurred as a result of growth in population stemming an increased birth rate and the influx of immigrants.

Post-Revolutionary America

The first system of laws implemented in the United States were instituted in the form of the Articles of Confederation, which granted the states a lot of political powers. At this time there was still no tax system in the fledgling nation, and the federal government relied on the States to donate revenues to the national treasury. As a matter of fact, the Articles of Confederation provided the states the freedom and autonomy to impose their own taxes on their own terms.

In 1789, the federal government was provided the power to raise revenues through taxes by the new Constitution of the United States of America when the Founding Fathers realized a solid government could not function effectively if it relied upon other governments to provide all of its capital.

The very first line of Article 1, Section 8 of the Constitution says:

"The Congress shall have the power, to lay and collect taxes, duties, imposts, and excises, pay the Debts and provide for the common defense and general Welfare of the United States; but all duties, imposts, and excises shall be uniform throughout the United States."Ever wary of the power of the central government to obscure that of the states, the responsibility behind federal tax collection resided with the states.

Thereafter, debts incurred from the American Revolution were paid by revenue collected from excise taxes levied by the Congress on such things as sugar, alcohol, tobacco, carriages, auctioned property, and certain legal documents.

Now that there was a new nation and a proper representation of Americans democratically in the form of a republican government, many citizens were still opposed to -- and even resisted -- taxes that they thought were unfair or unacceptable.

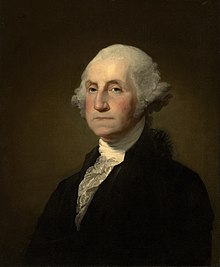

(Above: President George Washington, the nation's first president. Served from 1789-1797.)

With the Whiskey Rebellion of 1794 taking place over the collection of taxes on whiskey, President George Washington sent in federal troops to crush the rebellion. This action set a significant precedent that the federal government from which the federal government would not waver when it came to creating tax revenue and collecting taxes. The rebellion also established that the struggle against the British over taxation that resulted in the Declaration of Independence (1776) did not go away simply because a new, representative government was formed.

(Above: President John Adams, who served from 1797-1801. He presided over the United States during the "quasi-war" with France in the late 1790's, which resulted in the nation's first direct taxes being passed by Congress and enforced on the American people.)

The first direct taxes on landowners and owners of houses, were imposed by the federal government during the conflict with France. Because these taxes were paid directly to the government by taxpayers based on the item value, which was the basis for the tax, they were called direct taxes.

Federal taxes that followed evolved based on the critical role of the issue surrounding direct taxes versus indirect taxes. In 1802, following Thomas Jefferson's election to the presidency, direct taxes were eliminated. Other than excise taxes, there were no other forms of internal revenue. Thus, Jefferson established the concept of a less-intrusive government on the American people following two presidencies that propelled the government's agenda on taxation in the early republic.

(Above: Presidents Thomas Jefferson and James Madison. Jefferson served as president from 1801-1809, while Madison, his successor, served from 1809-1817.)

To pay for the War of 1812, Congress raised some new customs duties, implemented new excise taxes, and also raised revenues by issuing Treasury Notes. These taxes were repealed in 1817, at the end of the Madison administration. For 44 years, there would be no internal revenue collected by the federal government. Most of the government's revenue would come from public land sales and high customs duties.

Civil War-era:

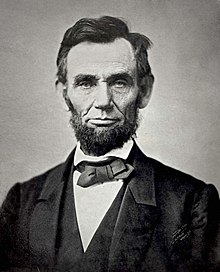

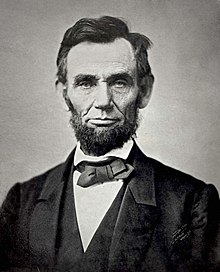

(Above: Picture of President Abraham Lincoln, who served from 1861-1865.)

At the time of taxes during the Civil War, the Revenue Act of 1861 was passed by Congress that resulted in the previous excise taxes being reinstated and the implementation of the United States' first ever personal income tax, whereby incomes of over $800.00 annually would be taxed at a rate of 3%. As most existing federal taxes had existed in the forms of duties and excises, taxing income took the federal system down a new path. Congress quickly realized there were some issues with the new income tax and thus did not collect them until a year later. With the war clearly dragging on, the federal debt was growing by approximately $2 million per day. By spring of 1862, it was clear the government was going to have to find another source of supplementary revenues.

To deliver these new revenues, Congress passed a whole new set of excise taxes on July 1, 1862 on things like yachts, pool tables, pianos, telegrams, feathers, leather, iron, playing cards, gunpowder, drugs, whiskey, and patent medicines. They also created and collected new license fees for many trades and professions and taxed many legal documents. There were central reforms made in the 1862 law that kind of prognosticated the main themes of many of the taxes in place today.

The concept the of the graduated income tax was initiated at this time. For example, Congress placed a multi-tiered tax rate structure that taxed incomes of $10,000 at 3% -- but made the tax rate 5% for more than $10,000. They enacted a standard deduction of $600 while also allowing numerous deductions for rental housing, repairs, loses, and other taxes paid. Also, to make sure taxes were paid on time, taxes were withheld by employers.

When the Civil War ended in 1865, much of the tax revenue was no longer needed and therefore many taxes were rescinded. By 1868, liquor and tobacco taxes were the federal government's primary sources of revenue. In 1872, they even did away with the personal income tax. For the next 48 years after 1868, the remaining excise taxes accounted for nearly 90% of the federal government's income.

The Story Behind the 16th Amendment:

(Above: Picture of President Woodrow Wilson, who served from 1913-1921. Courtesy of Wikipedia.)

(Above: Painting of former British Prime Minister William Pitt the Younger. Courtesy of Wikipedia.)

(Above on the Left: Karl Marx; on the Right: Fredrick Engel, co-authors of The Communist Manifesto. Courtesy of Wikipedia.)

(Above: Picture of Frank Chodorov.)

The courts have generally held that direct taxes are limited to taxes on people (variously called "capitation", "poll tax" or "head tax") and property. All other taxes are commonly referred to as "indirect taxes," because they tax an event, rather than a person or property per se. What seemed to be a straightforward limitation on the power of the legislature based on the subject of the tax proved inexact and unclear when applied to an income tax, which can be arguably viewed either as a direct or an indirect tax.

The first income tax suggested in the United States was during the War of 1812. The idea for the tax was based on the British Tax Act of 1798. The British tax law applied progressive rates to income. The British tax rates ranged from 0.833% on income starting at £60 to 10% on income above £200. The tax proposal was developed in 1814. Because the Treaty of Ghent was signed in 1815, ending hostilities and the need for additional revenue, the tax was never imposed in the United States.

(Above: Picture of President Woodrow Wilson, who served from 1913-1921. Courtesy of Wikipedia.)

In the year 10 AD, Emperor Wang Mang of the Xin Dynasty in ancient China instituted an unprecedented tax—the income tax—at the rate of 10 percent of profits, for professionals and skilled labor. (Previously, all taxes were either head tax or property tax.) He was overthrown 13 years later in 23 AD and earlier laissez-faire policies were restored during the Later Han.

(Above: Painting of Adam Smith, author of The Wealth of Nation. Courtesy of Wikipedia.)

One of the first recorded taxes on income was the Saladin tithe introduced by Henry II in 1188 to raise money for the Third Crusade. The tithe demanded that each layperson in England be taxed a tenth of their personal income and movable property. However, the inception date of the modern income tax is typically accepted as 1799.

Some economists trace the concept of the modern progressive tax to Adam Smith, who wrote this line in his famous publication on economics in 1776 titled The Wealth of Nations:

"The necessaries of life occasion the great expense of the poor. They find it difficult to get food, and the greater part of their little revenue is spent in getting it. The luxuries and vanities of life occasion the principal expense of the rich, and a magnificent house embellishes and sets off to the best advantage all the other luxuries and vanities which they possess. A tax upon house-rents, therefore, would in general fall heaviest upon the rich; and in this sort of inequality there would not, perhaps, be anything very unreasonable. It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion."

(Above: Painting of former British Prime Minister William Pitt the Younger. Courtesy of Wikipedia.)

The income tax was announced in Britain by Prime Minister William Pitt the Younger in his budget of December 1798 and introduced in 1799, to pay for weapons and equipment in preparation for the Napoleonic wars. Pitt's new graduated income tax began at a levy of 2d in the pound (0.8333%) on annual incomes over £60 and increased up to a maximum of 2s in the pound (10%) on incomes of over £200 (£170,542 in 2007). Pitt hoped that the new income tax would raise £10 million (£8,527,100,000 in 2007), but actual receipts for 1799 totaled just over £6 million.

The tax was repealed in 1816 and opponents of the tax, who thought it should only be used to finance wars, wanted all records of the tax destroyed along with its repeal. Records were publicly burned by the Chancellor of the Exchequer but copies were retained in the basement of the tax court.

(Above on the Left: Karl Marx; on the Right: Fredrick Engel, co-authors of The Communist Manifesto. Courtesy of Wikipedia.)

In The Communist Manifesto (1848), Karl Marx wrote ten plancks that base their agenda for the future implementation of communism. Within the Second Planck is listed in step two the first Western words about an income tax. It is worded this way:

"2. A heavy progressive or graduated income tax."

(Above: Picture of Frank Chodorov.)

Frank Chodorov, a member of the "Old Right" that consisted of a group of libertarian thinkers, wrote about his opinions on the implementation of the income tax system:

"... you come up with the fact that it gives the government a prior lien on all the property produced by its subjects." The government "unashamedly proclaims the doctrine of collectivized wealth. ... That which it does not take is a concession."

Plato said in The Republic (Approx. 380 B.C.):

"When there is a income tax, the just man will pay more than the unjust on the same amount of income."

In Poor Richard's Almanac, Benjamin Franklin said:

"It would be a hard government that should tax its people one-tenth part of their income."

The common criticism many Americans have had since the passage of the 16th Amendment is the creation of the welfare state and socialism that resulted from it. So for, the people have been right.

(Above: Plato, author of The Republic. Courtesy of Wikipedia.)

In 1794 while serving in the U.S. House of Representatives, James Madison said this about taxation's consequence and the constitutionality behind it:

"I cannot undertake to lay my finger on that article of the Constitution which granted a right to Congress of expending, on objects of benevolence, the money of their constituent."

The economic effects of an income tax system are that it penalizes work, discourage saving and investing, and hinder the competitiveness of business and economic growth. Income taxes are also not border-adjustable; meaning the tax component embedded into products via taxes imposed on companies cannot be removed when exported to a foreign country.

Article I, Section 8, Clause 1 of the United States Constitution (the "Taxing and Spending Clause"), specifies Congress's power to impose "Taxes, Duties, Imposts and Excises," but Article I, Section 8 requires that, "Duties, Imposts and Excises shall be uniform throughout the United States."

The Constitution specifically limited Congress' ability to impose direct taxes, by requiring Congress to distribute direct taxes in proportion to each state's census population. It was thought that head taxes and property taxes (slaves could be taxed as either or both) were likely to be abused, and that they bore no relation to the activities in which the federal government had a legitimate interest. The fourth clause of section 9 therefore specifies that, "No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken."

(Above: Painting of Alexander Hamilton, first Secretary of State of the United States under President George Washington, serving from 1789-1795. Courtesy of Wikipedia.)

Taxation was also the subject of Federalist No. 33, which was penned secretly by the Federalist Alexander Hamilton under the pseudonym Publius. In it, he asserts that the wording of the "Necessary and Proper Clause should serve as guidelines for the legislation of laws regarding taxation. The legislative branch is to be the judge, but any abuse of those powers of judging can be overturned by the people, whether as states or as a larger group.

The courts have generally held that direct taxes are limited to taxes on people (variously called "capitation", "poll tax" or "head tax") and property. All other taxes are commonly referred to as "indirect taxes," because they tax an event, rather than a person or property per se. What seemed to be a straightforward limitation on the power of the legislature based on the subject of the tax proved inexact and unclear when applied to an income tax, which can be arguably viewed either as a direct or an indirect tax.

The first income tax suggested in the United States was during the War of 1812. The idea for the tax was based on the British Tax Act of 1798. The British tax law applied progressive rates to income. The British tax rates ranged from 0.833% on income starting at £60 to 10% on income above £200. The tax proposal was developed in 1814. Because the Treaty of Ghent was signed in 1815, ending hostilities and the need for additional revenue, the tax was never imposed in the United States.

As mention above, in order to help pay for its war effort in the American Civil War, Congress imposed its first personal income tax in 1861.

Pollock v. Farmers' Loan and Trust Co. (1895): The Case that Should Have Prevented

the 16th Amendment

(Above: Photo of U.S. Chief Justice of the Supreme Court Melville Fuller, who presided over the case Pollock v. Farmers' Loan and Trust Co. Courtesy of Wikipedia.)

In August 1894, the Wilson-Gorman Act, a tax and tariff measure, was signed into law. It levied a 2% tax on incomes $4,000 or more. The tax was applied to "gains, profits, and income derived from any kind of property, rents, interests, or salaries from any profession, trade, employment, or vocation." This also included inheritances and gifts. The tax was applied to net profits for corporations, companies, and associations.

Shareholders of corporations immediately sued to keep their corporations from paying the tax. The various cases were consolidated into Pollock v. Farmers' Loan and Trust Co. and accepted by the U.S. Supreme Court in January 1895. The plaintiffs, represented by William D. Guthrie, George F. Edmunds, and Joseph Choate, claimed that the income tax would induce class warfare that would lead to "communism, anarchy, and then, the ever following despotism."

As for constitutional arguments, the plaintiffs insisted that the income tax was a direct tax -- the law's tax on real property was the equivalent of a property tax, which was a direct tax. Article I, Section 8 states that "...all Duties, Imposts, and Excises shall be uniform throughout the United States." The plaintiffs charged that the vast majority of the affected taxpayers live in the states of New York, New Jersey, Connecticut, and Pennsylvania. In addition, the tax was not uniform because it was imposed on some kinds of income.

The defense, represented by Richard Olney and James C. Carter, countered with precedent. They maintained that the income tax was not a direct tax. They cited a 1796 U.S. Supreme Court decision that upheld a carriage tax, clearly determining that direct taxes referred to only property. Other taxes upheld by the Supreme Court in the past included taxes on insurance companies and the Civil War income tax.

Another argument posed by the defense took on the plaintiffs' issue of class warfare. Carter asserted that the best way to preserve private property was to relieve the masses of excessive tax burdens. The poor had paid more than their fair share through consumption taxes and tariffs and the income tax would serve as a balance. The income tax would be a safety valve in an era of labor unrest.

The Court decided the case in April of that year, deciding "property was sacrosanct," and that "economic regulation was taboo," according to writer Burt Solomon. Chief Justice Melville Fuller, writing for the 5-3 majority, declared that income taxes on real estate was a direct tax and therefore unconstitutional. The majority also discarded the tax on interest from municipal bonds as an infringement on the states. However, with one justice absent, other issues in the case split 4-4, and thus the case was retried.

In May, with a full compliment of justices, the Court threw out the entire Wilson-Gorman Act by a 5-4 margin. Fuller, again for the majority, wrote that the unconstitutionality of the income tax on real estate scuttled the whole law, despite the possibility of some new taxes, like wages, being unconstitutional. Dissenting, John Harlan stated that it was a dangerous precedent in ruling income taxes unconstitutional, citing that it could open society to social unrest.

Both sides in Pollock v. Farmers' Loan and Trust Co. feared that unrest if they did not prevail, and neither could agree on the definition of a direct tax as written in the Constitution. What became apparent, according to Harlan, was that a constitutional amendment allowing income taxes would be needed. Thus, in 1912, the 16th Amendment was passed, providing Congress the legal authority to pass an income tax, and the first signs of big government in American government came to fruition, and proved yet another example where a decision and precedent set by the U.S. Supreme Court went ignored much like Worcester v. Georgia, when after Chief Justice John Marshall ruling vacated the conviction of Samuel Worcester and held that the Georgia criminal statute prohibiting non-Indians from being present on Indian lands was unconstitutional, President Andrew Jackson uttered the famous line, "John Marshall has made his decision. Now let him enforce it!"

For the next 15 years (1896-1910), the primary source of revenue was via high tariffs due to the lack of an income tax and because there was such opposition to other forms of direct taxation. In 1899, the Wilson-Gorman Act was passed in order to fund the Spanish-American War. This raised revenues through bond sales, taxes on recreational facilities used by employees, increased tobacco and beer taxes, and also on chewing gum. When the Act expired three years later, federal revenues dropped from 1.7% to 1.3% of domestic GDP.

As the result of the 1895 Court ruling on the income tax, the Wilson-Gorman Act resorted to traditional methods of raising revenues, although there were ongoing, vigorous debates on other methods and possible new ways to raise revenues. According to Easy-Tax Information.com, it became quite clear apparent throughout the country that excise taxes and high tariffs weighed much more heavily on the less prosperous was were thus not economically sensible. Ultimately, the debate over income taxes was between members of Congress in the South and West who represented rural and agricultural areas, and those in the Northeast industrial areas. In time, there was a agreement to enact a tax on business income that the leaders in Washington called an "excise tax."

More importantly, Congress passed a constitutional amendment allowing the government to tax the lawful income of U.S. citizens regardless of state population. This amendment, the 16th Amendment, was ratified by 36 states by 1913, and the Democratic Congress enacted a new federal income tax law in October of that year with rates ranging from 1% all the way to 7% for those Americans earning a salary of more than $500,000. This was signed into law by President Woodrow Wilson, a Democrat who was a leader in the Progressive movement that championed the cause of an income tax. Thus. the Populists and Progressives who infiltrated the federal government during the late 19th and early 20th Centuries got their wish -- the spark that would eventually result in the creation of the welfare state, big government, and the government's constitutional mandate to manipulate the economy through the implementation of taxes. Also, this would mark the beginning toward the concept of class warfare in American society that would become so prevalent, particularly when Franklin Roosevelt took office in 1933.

Wilson, through the passage of the 16th Amendment, created the prototype behind the Democratic big government politics. Some of the ways he expanded the size of government were as follows:

- The creation of the Federal Reserve Back on December 23, 1913 with Congress' passage of the Federal Reserve Act. Congress established three key objectives for monetary policy in the Federal Reserve Act: Maximum employment, stable prices, and moderate long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and today, according to official Federal Reserve documentation, include conducting the nation's monetary policy, supervising and regulating banking institutions, maintaining the stability of the financial system and providing financial services to depository institutions, the U.S. government, and foreign official institutions. The Fed also conducts research into the economy and releases numerous publications, such as the Beige Book.

- The above-mentioned 16th Amendment.

- The 17th Amendment, which gives the American people the right to vote for U.S. Senators. The amendment supersedes Article I, § 3, Clauses 1 and 2 of the Constitution, under which senators were elected by state legislatures. It also alters the procedure for filling vacancies in the Senate, allowing for state legislatures to permit their governors to make temporary appointments until a special election can be held.

By 1917, the federal budget for that one year was almost the same as all of the budgets for the previous 25 years combined! The war and all of the newly collected tax revenues were the driving factors in the absurdly expanded federal budget! The government had become too big, and too oppressive in the views of most of today's conservatives. It was about this time that income taxes began to get out of control. A s the government wanted even more tax revenues, Congress passed the 1917 War Revenue Act, which increased tax rats even higher, while reducing exemptions at the same time. Before this latest Act, a 15% tax rate only kicked in on incomes over $1.5 million. But now, that income bracket was required to pay 67%, while those earning just $40,000 were slapped with a 16% rate.

Then Congress did it again in 1918 with yet another Act, raising the bottom and top tax rates to 6% and 77% respectively! These back-to-back annual increases brought 1918 tax revenues to $3.6 billion, up from the 1916 revenues of just $761 million. According to Easy-Tax Information.com, that is an increase in federal revenue of 475%. At this point, the tax burden was equal to 25% of GDP and while a full third of the war's cost was being funded by the income tax, still only about 5% paid income taxes at all. And while the economy was thriving due to the wartime economy, nevertheless the institution of class warfare had accelerated.

By violating the spirit for which the American Revolution and the Constitution were fought, Woodrow Wilson said these words regarding his record as president:

"I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit... all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the civilized world, no longer a Government by free opinion, no longer a Government by conviction and the vote of the majority, but a Government by the opinion and duress of a small group of dominant men."At least Wilson was man enough to admit his creating big government politics in the U.S. was a mistake.

"The Roaring '20's": The Economic and Tax Policies of the Harding, Coolidge, and Hoover AdministrationsIn an article from The Heritage Foundation titled "The Historical Lessons of Lower Tax Rates," the economic and tax policies of the 1920 are described accordingly:

"Under the leadership of Treasury Secretary Andrew Mellon during the Administrations of Presidents Warren Harding and Calvin Coolidge, tax rates were slashed from the confiscatory levels they had reach in World War I. The Revenue Acts of 1921, 1924, and 1926 reduced the top rate from 73 percent to 25 percent.

Spurred in part by lower tax rates, the economy expanded dramatically. In real terms, the economy grew 59% between 1921 and 1929, and annual economic growth average more than 6 percent.

Notwithstanding (or perhaps because of) the dramatic reduction in tax rates, personal income tax revenues increased substantially during the 1920s, rising from $719 million in 1921 to $1,160 million in 1928, an increase of more than 61 percent (this was a period of no inflation).4

This surge in revenue was no surprise to Mellon:The share of the tax burden borne by the rich rose dramatically. As seen in Chart 5, taxes paid by the rich (those making $50,000 and up in those days) climbed from 44.2 percent of the total tax burden in 1921 to 78.4 percent in 1928."

Personal income tax revenues increased substantially during the 1920s, despite the reduction in rates. Revenues rose from $719 million in 1921 to $1164 million in 1928, an increase of more than 61 percent (this was a period of virtually no inflation)."'The History of taxation shows that taxes which are inherently excessive are not paid. The high rates inevitably put pressure upon the taxpayer to withdraw his capital from productive business and invest it in tax-exempt securities or to find other lawful methods of avoiding the realization of taxable income. The result is that the sources of taxation are drying up; wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people.'"

In an article on Fee.org, the concept of the income tax according to the article's author Dr. Gene Smiley. professor at Marquette University, was to redistribute wealth and income. However, with the 1920's tax and economic policies, some of those trends were bucked, and the economy prospered

"Recent political debates have raised the issue of adopting a flat marginal rate federal income tax. Though the marginal rate would be flat, the addition of a generous personal exemption would make the average personal income tax rate rise as it approached the fixed marginal rate of, say, 17 or 20 percent. This issue has generated considerable controversy in political debates and in the press. Among the criticisms leveled at a flat marginal rate tax system are that, contrary to proponents’ claims, a flat marginal tax rate will provide a windfall of after-tax income for the already wealthy, worsen the distribution of income, and exacerbate the already swollen federal government deficits. Supporters have usually concentrated on extolling the virtues of reducing the distortions caused by rising marginal tax rates and of encouraging greater entrepreneurial activity.

Ideally, there would be no personal income tax. The history of the debates over an income tax in the 1890-1911 era makes it clear that an income tax was viewed by its advocates as a means to redistribute income and wealth. It has remained this way as indicated by the vestiges of the progressive marginal rate structure which remain in the code. Such a system leads to an emphasis on obtaining more through political redistribution rather than the expansion of economic activity. And by separating the perceived benefits of a governmental activity from any taxes dedicated to supporting that activity, the income tax made it easier to expand government and increase taxes. The creation of a federal income tax system aimed at the redistribution of income as much as creating a new source of federal tax revenues was one of the worst mistakes in American history.

The Tax Cuts of the 1920s

There are three periods where there were significant tax rate cuts which moved toward a flatter tax rate structure: the 1920s, the 1960s, and the 1980s. All exhibit some of the same characteristics, but the tax cuts of the 1960s were smaller than those of the 1920s, and in the 1980s the sharp increases in tax rates for the Social Security system partially offset the cuts in the federal income tax rates.

The first permanent federal income tax was enacted in 1913, and during the First World War there were dramatic increases in the rates in an attempt to generate increased tax revenues. At $4,000 net income, the marginal rates rose from 1 percent in 1915 to 6 percent in 1918; at $25,000 net income from 2 percent to 23 percent; at $100,000 net income from 5 percent to 60 percent; and, at $750,000 net income from 7 percent to 76 percent. The rates were reduced in 1922, 1924, and 1925. By 1925 the highest marginal rate was 25 percent for $100,000 and more net income. By the late 1920s only about the top 7 to 8 percent of Americans were subject to federal personal income taxes. Though the marginal rate was not constant, the changes were close enough to that which would occur with a flat rate tax that the results of the tax cuts of the 1920s can suggest what would happen with the adoption of a flat rate federal income tax.

Tax Cuts for the Wealthy?

A common criticism of the proposal for a flat marginal rate tax is that it would generate a windfall for the wealthy and create greater inequalities in income distribution. Such charges were also made in the 1920s, 1960s, and 1980s. In the 1920s, tax rates were reduced much more for the higher-income taxpayers because, obviously, they had much higher marginal tax rates in 1918. For example, the marginal income tax rate was reduced 51 percentage points (76 percent to 25 percent) between 1918 and 1925 for taxpayers with at least $750,000 of net income, while the reduction for a taxpayer with $6,000 net income over that period was only 10 percentage points (13 percent to 3 percent). However, the relative reduction (decrease as a percent of the 1918 marginal tax rate) was somewhat larger for the lower-income taxpayers than for the higher-income taxpayers.

More importantly, the reduction in tax rates shifted the effective burden of taxation. When rates had been increased between 1915 and 1918 the higher-income taxpayers had found various ways to shelter their income from taxes. At the same time as the number of returns in the lower net-income brackets rose as exemptions were reduced, the number of returns in the higher-income brackets fell. As examples, for the $500,000 to $1,000,000 net income class, the number of returns fell from 376 in 1916 to 178 in 1918, and for the $250,000 to $500,000 net-income class the number of returns fell from 1,141 to 629 over the same period. The result was that the share of income taxes paid by the higher net income tax classes fell as tax rates were raised. With the reduction in rates in the twenties, higher-income taxpayers reduced their sheltering of income and the number of returns and share of income taxes paid by higher-income taxpayers rose. For example, the share of total personal income taxes paid by taxpayers with net incomes of $1,000,000 or more rose from 5.75 percent in 1923 to 15.9 percent in 1927. For taxpayers with net incomes of $250,000 to $500,000 their share of total personal income taxes rose from 6.82 percent in 1923 to 12.40 percent in 1927. The share for taxpayers with net incomes of $100,000 to $250,000 rose from 15.7 percent in 1923 to 21.91 percent in 1927. However, taxpayers with net incomes of $25,000 or less paid 36.22 percent of all personal income taxes in 1923 but only 12.83 percent in 1927. Thus, cutting tax rates effectively shifted the tax burden from the lower-income taxpayers toward the higher income taxpayers.

The assertion that the tax cuts would primarily benefit higher-income taxpayers was tied to the contention that this would create more income inequality. It has always seemed contradictory to me to argue that allowing a person to retain more of the income he or she generated would create more income inequality, but that has been the common contention. The conventional measures did show significant increases in income inequality during the twenties but there were problems with these measures. They were developed from the income reported on income tax returns and separate estimates of total income in the economy. However, as tax rates fell during the twenties, higher-income individuals began shifting wealth so that less of their income was sheltered from taxes. A portion of the greater income gains of the higher-income individuals represented not additional income but income from wealth which was shifted from tax shelters to assets subject to taxation. Correcting for this significantly reduces the rise in income inequality during the twenties.

What of the rise in income inequality that did occur? Individuals receive earnings from the productivity of their capital investments and land as well as their labor. They also receive income in the form of the realized gains in the values of their assets. The values of financial assets, particularly stocks, began to rise by the mid-twenties and this culminated in the great stock market boom of the late twenties. To see what effect this had, I calculated income shares which excluded realized capital gains, and when this was done, essentially all of the rise in income inequality in the twenties disappeared.

Thus, this evidence suggests that the dramatic tax cuts associated with moving toward a flatter rate tax structure would not provide windfalls of income for the wealthier taxpayers. It would encourage them to shift wealth from tax-sheltering investments to taxable investments to receive larger after-tax returns. The movement of economic activity out of lower return tax sheltering into higher return taxable assets will create more efficiency and make people in the society better off.

Larger Government Budget Deficits?

Another argument frequently thrown at the supporters of a flat marginal rate income tax is that it would worsen the annual deficits of the federal government. This would occur because expenditures would continue at the same level while revenues would decline. Once more we can examine evidence from the twenties which is related to this. With the end of the First World War the federal government’s expenditures dropped sharply, though not to the prewar levels, and budget surpluses were created. There were calls to reduce the income tax rates to direct investment into more appropriate channels rather than into activities which were primarily directed to tax avoidance, and to reduce the widespread legal tax avoidance by the upper-income taxpayers. For example, Andrew Mellon, Secretary of the Treasury, reported that when William Rockefeller (John D.’s brother) died in 1922 he held less than $7,000,000 in Standard Oil bonds but over $44,000,000 of wholly tax-exempt securities. The inability of Congress to find legislation to effectively reduce this tax avoidance was one force leading to the twenties’ tax cuts.

The first of the major tax cuts was passed in November of 1921. On average it reduced marginal personal income tax rates by 13.8 percent, and this led to a decline in real total federal personal income tax revenues of 4.3 percent. The second major tax cut was approved in June of 1924 and it reduced marginal income tax rates by an average of 7.5 percent. This tax cut lead to an increase in real total federal personal income tax revenues of 5.9 percent. The final major tax cut was introduced in December 1925 and enacted in February 1926. It applied retroactively to 1925. On average marginal personal income tax rates were reduced 33.6 percent by these changes. Rather than falling, real federal personal income tax revenues increased by 0.5 percent with this large tax cut.

The evidence clearly indicates that, in general, tax revenues rose with the tax cuts of the twenties. The federal government’s budget surpluses were not reduced with the final two tax cuts and, over the course of the twenties, these budget surpluses allowed the federal debt to be reduced by 25 percent.

Conclusions

The flat marginal rate income tax may never be enacted. Many people, and this certainly includes many politicians, believe that it is only fair that higher-income individuals face higher marginal rates of income taxation. The tenacity with which supporters of progressive tax rates cling to this idea is indicative of their redistributionist philosophy. It also indicates their refusal to face reality. The tax cuts of the twenties as well as every major income tax cut has resulted in an effective shift of the tax burden from lower- to higher-income taxpayers. As the twenties show, it does not have to worsen the government’s deficit. Economic growth in the twenties surged with the tax cuts, and prices were nearly stable while unemployment rates averaged around 4 percent.[4] The government ran surpluses which allowed it to reduce the federal debt by 25 percent. The decreases in marginal tax rates led individuals to pull their investments out of ones designed to avoid taxes—investments such as tax-exempt municipal bonds, personal service corporations, and other avenues to avoid distributing corporate profits. The result was a rising tide of investment in new, growing, and sometimes risky businesses and industries such as radio, consumer household electric appliances, electric utilities, airplane manufacturers, rubber tire manufacturers, supermarket chains, and so forth. The 1920s were a vibrant, growing decade, and the tax cuts of the 1920s certainly were an important part of what brought this about."So during the 1920's, the economy boomed. New York became the financial capital of the world. The Federal Reserve assumed a more dominant role as a result. Congress was able to reduce the top and bottom percentages back to 25% and 1%, respectively, and tax revenues were back down to 13%. Interestingly, the economy became even stronger with these reductions in tax rates and tax revenues.

(Above: Picture of President Warren G. Harding, who served from 1921-1923)

President Warren G. Harding cut federal spending, lowered taxes, and began paying off the wartime national debt. He restored prosperity by 1921, opening a decade of rapid growth known as the Roaring 20s.